- calendar_month January 26, 2023

Photo credit: Envato

Here at JohnHart, we’re pretty big into home loan pre approval. Unfamiliar? A pre approval questionnaire helps you determine a feasible mortgage amount for your current situation. In most cases, a pre approval will be processed online or face-to-face with your loan officer. But the process is so simple that you can also find self-service options!

Consider home loan pre approval to be a test run for a home loan application. It works by assessing information you provide such as your credit score, your current income, and the fun part… a hypothetical home. And when the dust settles, a comprehensive home loan pre approval will tell you:

- An estimate on your monthly housing payment

- An estimate on how much you can expect to pay for a mortgage

- The most expensive home you can afford

- Minimum downpayment

- The closing cost for your mortgage

Photo credit: Envato

But most importantly, a pre-approval can help speed up the loan approval process. Now that we’ve sold you on the power of pre-approval, you’re probably wondering how to get one for yourself. Fortunately, it’s a rather simple process.

What to Expect When Pursuing Home Loan Pre Approval

In most cases, it’s best to get your home loan pre approval started well in advance of seeking any loans for homes. We’re talking a solid year in advance. That being said, everything happens when it happens, so do what works for you.

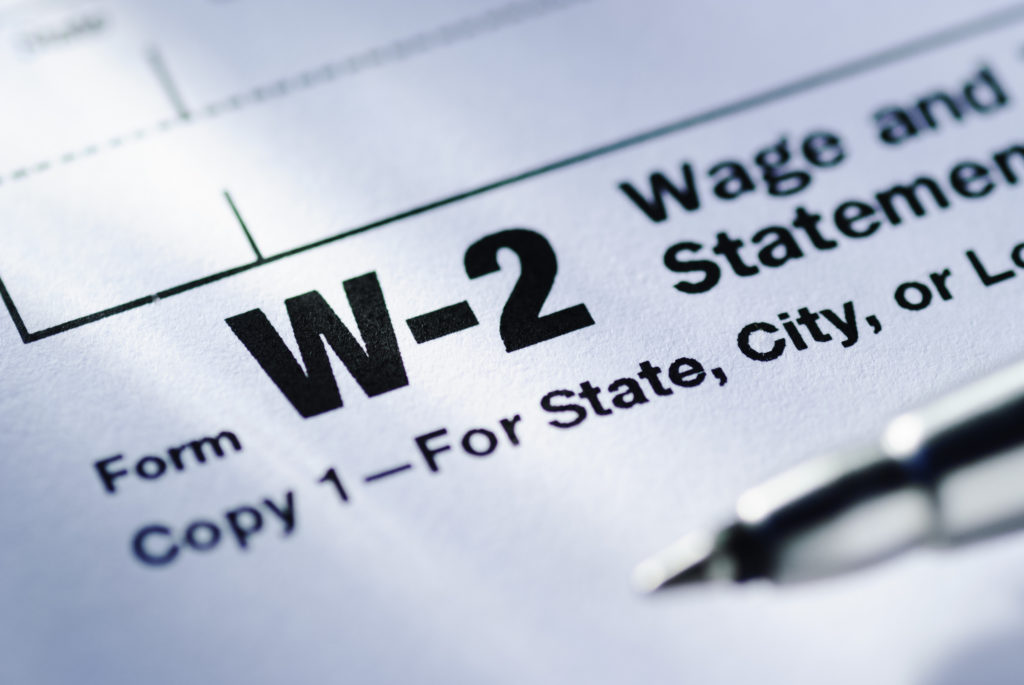

A loan officer will need supporting documents to back up the information provided in your pre approval questionnaire. Be prepared to provide:

- Bank account statements

- Student loan information

- Pay stubs

- Tax returns

- W-2 forms

Photo credit: Envato

Ultimately, it will fall on you to decide what you’re comfortable paying for a home. It’s a figure that you should also have handy when filling out a home loan pre approval. Just be careful. When you come face-to-face with your lender, they may offer a loan that exceeds your monthly budget. And since this is your dream of homeownership, it could be tempting to take it. Don’t fall into this rut, or your dream will quickly become a long-term nightmare.

Applying for a Loan Pre Approval

Lending agencies tend to have their own ways of doing things. Therefore, we went straight to the source: Mike Pandazos of Golden Coast Finance. He was happy to break down his procedure for us.

Mike typically kicks things off with a quick phone interview that can run anywhere from five to 15 minutes. At the client’s preference, he can also conduct this pre-interview by text or email. From there, he’ll either schedule a face-to-face interview or, more commonly, send the client a link for online application.

Photo credit: Envato

Once the application has been submitted, the client can then upload the supporting documentation we mentioned above. Typically, the process only takes one to two business days. Once received, the home loan pre approval is valid for 90 days, owing to the credit report expiration.

Will Pre Approval Application Hurt Your Credit?

Some applicants are concerned about seeking home loan pre approval out of fear that it will reduce their credit score. In a way, they’re correct. But don’t let that discourage you from seeking pre approval. The drop in credit score is as negligible as it is temporary.You’re also granted a 45-day window to keep shopping for your pre approval without fear of accruing multiple credit score drops. So shop with confidence!

Don’t Confuse Pre Approval with Pre Qualification

It can be easy to confuse a home loan pre approval with a pre qualification. But pre-qualifications aren’t supported by a lender. Therefore, they lack the potency of a pre approval. When a seller is looking for reliable backing in a buyer, they’ll commonly look for a home loan pre approval since it’s reinforced with lender approval.

Photo credit: Envato

How the Right Agent Can Help Your Home Loan Pre Approval

So, if you can fill a home loan pre approval out yourself, where does an agent come into play? You can make things a lot easier on yourself by finding an agent who understands the full spectrum of a transaction.

The agents at JohnHart enjoy an added benefit of having our own in-house finance and escrow companies. These kinds of relationships add a further depth of understanding that can begin well outside the standard parameters of a transaction. And, as you can imagine, agents with strong relationships in the financial sector can be especially helpful during the financing process.

Ready to take your first steps in getting your home loan pre approval? Then reach out to one of our agents who can help guide you through the process!